Under the Decree that entered into force on April 24, 2021, on subcontracting and the agreement by which the general provisions for the registration of natural or legal persons who provide specialized services or perform specialized work published on May 24, 2021, any company that makes its employees available to another company to perform its services on the premises of the beneficiary must be understood as a specialized service and must obtain its certificate of registration of specialized services in REPSE.

Through a decree published on July 31, companies have been granted additional time until September 1, 2021, to obtain their specialized services approval.

Therefore, as of September 1, in the event of the need to contract a specialized service or work company, it will be essential to request the following documents from the provider:

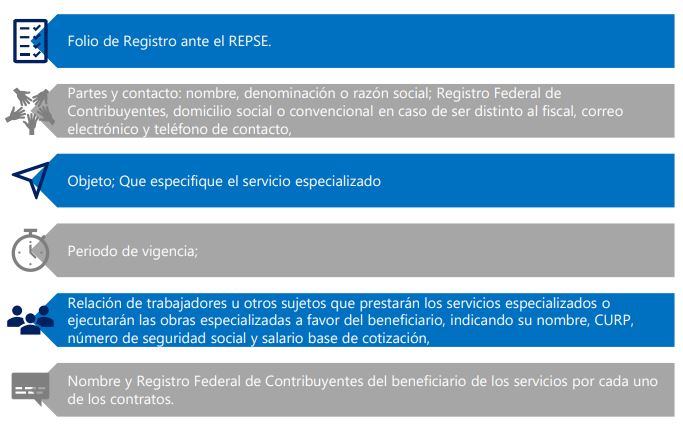

✓ A single copy of the provider's REPSE registration.

✓ A signed contract between the company and the provider with the following

information:

Additionally, Article 14 of the Federal Labor Law, as well as Article 15-A of the Social Security Law and Article 29-Bis of the INFONAVIT Law, as amended by the Decree, provide for joint and several liability of the contractor with the contractor in connection with the workers used to perform the rendering of specialized services in the event the contractor fails to comply with its social security obligations. For the above mentioned and based on the guidelines of the Income Tax Law and the Federal Tax Code, the contractor must request the following documents from the contractor for purposes of deducting and crediting income tax and VAT, as well as to avoid any joint and several liabilities: • Registration with the IMSS or the most recent modifications of the salaries of the workers made available • Monthly and bimonthly certificate of worker-employer contributions with the allocation of all employees • SIPARE format with proof of payment • Social security compliance opinion • INFONAVIT compliance opinion • Opinion of compliance issued by SAT • CFDI of employee payroll payments • Monthly tax return with proof of payment The documents mentioned above are considered confidential information of the service provider and contain the employees' data. Therefore, the client must safeguard them with the highest standards of protection. Therefore, the service provider may request the signing of a confidentiality agreement, or the agreement for the provision of specialized services may include a confidentiality clause.